Our Business Our Business Top CLOSE

- Our Business

- Our Company

-

IR Info

IR Info IR Info Top CLOSE

-

Sustainability

Sustainability Sustainability Top CLOSE

- Home

- Sustainability

- Governance

Governance

Corporate Governance

Basic Approach

The Hagiwara Electric Group is fully aware of the importance of corporate governance, and we are working to improve the transparency and soundness of our management. Compliance is at the heart of corporate governance. In all our business activities, not only do we strictly comply with laws and regulations, but we also act with the awareness that we are a member of society.

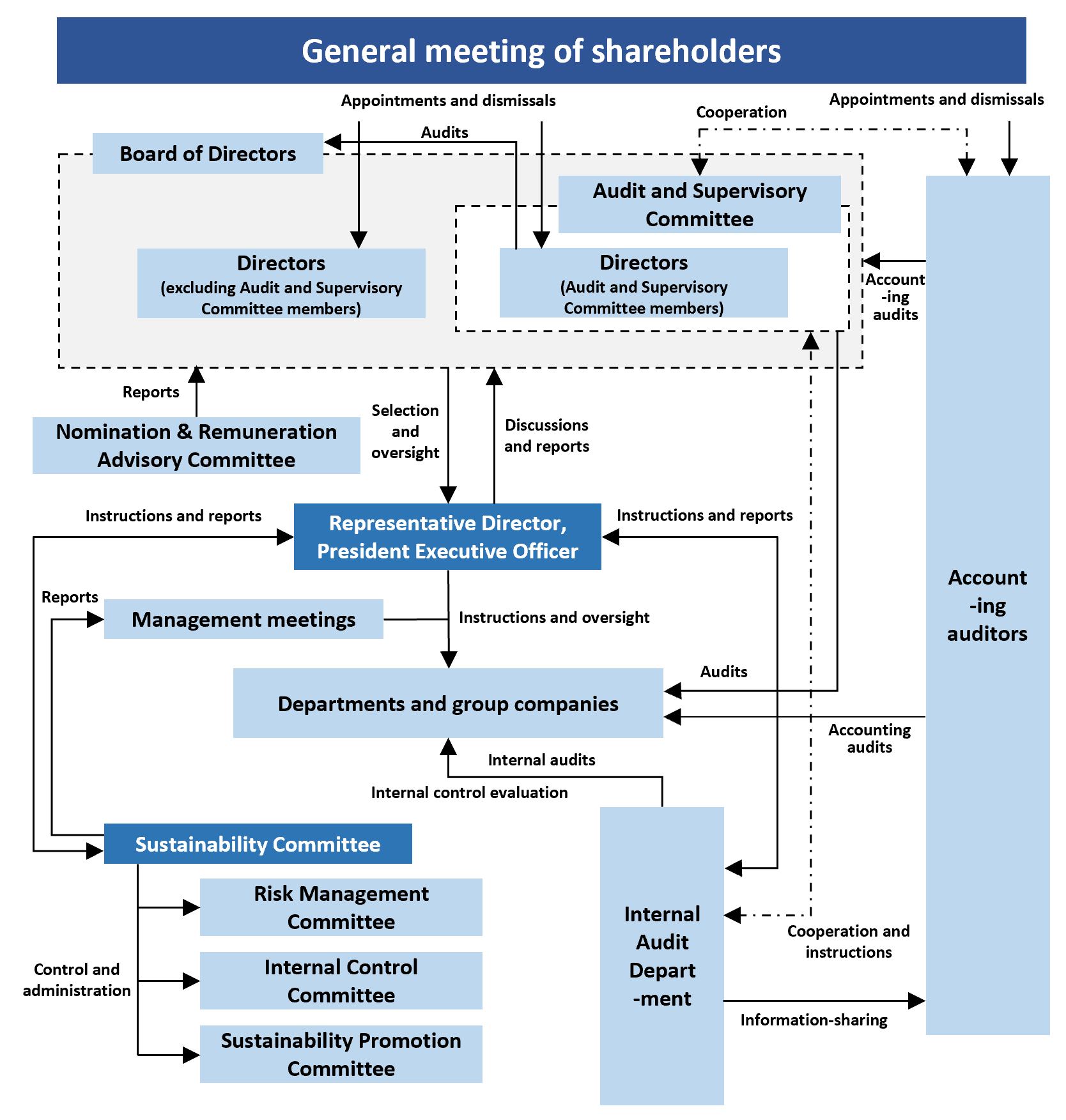

Corporate Governance System

As a pure holding company, we have adopted the structure of a company with an Audit and Supervisory Committee. Our Board of Directors currently consists of five directors (excluding the directors who are members of the Audit and Supervisory Committee) and three directors who are members of the Audit and Supervisory Committee (including two outside directors).

The three directors who are on the Audit and Supervisory Committee constitute the Audit and Supervisory Committee, and one of those directors is a full-time member of the Audit and Supervisory Committee. In addition, in order to delegate authority to each operating subsidiary for efficient business execution with speedy group management as our aim, we assign directors who are well versed in business operations to each operating subsidiary to accurately respond to changes in the business environment and to speed up and improve the efficiency of their business execution.

Our directors (excluding the directors who are members of the Audit and Supervisory Committee) attend monthly management meetings to discuss and report on the overall management of the Hagiwara Electric Group. The full-time Audit and Supervisory Committee member attends management meetings as an observer.

Furthermore, with the aim of cross-sectionally promoting overall initiatives for corporate governance and sustainability management at all group companies, we have established our Sustainability Committee, which is chaired by our Representative Director, President Executive Officer. The Sustainability Committee regularly verifies compliance and the appropriateness and effectiveness of internal control systems, and makes improvements and corrections regarding problem points. It also strengthens risk management and works on resolving various issues related to the SDGs and ESG.

With regard to external audits, we have signed an audit agreement with KPMG AZSA LLC, and they conduct accounting audits and internal control audits from an independent standpoint.

Reasons for Choosing the Current Corporate Governance System

The Hagiwara Electric Group transitioned to a pure holding company structure on April 1, 2018. As a holding company, we have established a Board of Directors, an Audit and Supervisory Committee, and an accounting auditor, and each operating subsidiary has also established its own Board of Directors and auditors in order to achieve balance between management monitoring and business execution, as well as to ensure highly transparent management and improved agility of the Group as a whole.

Corporate Governance Chart (as of April 1, 2025)

Dialogue with Shareholders and Investors

Basic Approach

Through dialogue with all our shareholders and investors, we hope to provide a better understanding of our company and solicit diverse opinions in order to increase management efficiency and transparency and increase our corporate value.

Investor Relations

The Representative Director and Representative Director, President Executive Officer is responsible for interacting with investors at company briefings, and investor relations personnel appointed by the Representative Director, President Executive Officer are generally responsible for conducting one-on-one meetings with investors.

Meetings take place online and by telephone with the aim of facilitating dialogue with a larger number of investors. Presentation materials and summaries of Q&A summaries are also published on the company website.

Feedback received through IR activities is passed on to the Board of Directors, management, and relevant departments as necessary in order to share and utilize that information.

Going forward, we shall endeavor to provide appropriate and fair information disclosure for all our shareholders and investors.

Status of Dialogue with Investors

| Dialogue Format and Events | FY2023 Results | |

|---|---|---|

| For Institutional Investors | Company Briefings (Online) | Twice |

| One-on-One Meetings |

Japanese institutional investors |

|

| For Individual Investors | Company Briefings (Online) | Once |

| Investor Relations Exhibitions | Once | |

Risk Management

Basic Approach

Based on the belief that it is essential to accurately deal with various risks that may have a significant impact on the management of the Hagiwara Electric Group, we are striving to develop and bolster our risk management system through measures that include identifying and preventing potential risks through communication with stakeholders and formulating measures to minimize damage in the event that risks materialize.

Risk Management System

Based on control and administration by the Sustainability Committee, we have established the Risk Management Committee at our group with the aim of promoting company-wide risk management. The Risk Management Committee formulates policies and plans regarding company-wide risk management, examines preventive and corrective measures, and monitors the status of progress. Furthermore, working groups have been set up to deal with individual risks, and a system has been established to examine specific measures for individual issues, develop manuals including various regulations and guidelines, promote and implement risk management activities in the workplace, etc., and report to the Risk Management Committee.

Risks to the Operations of the Hagiwara Electric Group

The following 14 items have been identified as risks to the operations of the Hagiwara Electric Group, based on discussions at meetings of the Board of Directors of Hagiwara Electric Holdings Co., Ltd.

- Risks related to the automotive industry

- Risks from dependence on specific customers

- Risks from dependence on specific suppliers

- Risks related to product quality

- Risks related to new businesses

- Risks related to inventory valuation losses

- Risks related to the impairment of fixed assets

- Risks related to exchange rate fluctuations

- Risks associated with overseas activities

- Risks due to natural disasters

- Risks related to compliance

- Risks related to information security

- Risks related to personnel recruitment

- Risks related to share dilution

Compliance

Basic Approach

In addition to giving top priority to compliance, the Hagiwara Electric Group is working to strengthen its governance management and to thoroughly ensure the integrity of its internal controls and information security.

Compliance Promotion System

Under the supervision and management of the Sustainability Committee, the Group has established an Internal Control Committee, which regularly examines the adequacy and effectiveness of compliance and internal management systems, improves and corrects problems, and works to enhance internal control and compliance-related risk management, etc. Furthermore, this committee implements compliance education for the employees of all group companies, and thereby works hard to ensure thorough legal compliance.

Basic Policies

The Hagiwara Electric Group has established the Hagiwara Electric Group Code of Conduct and the Hagiwara Electric Group Business Conduct Charter as its basic policies for compliance, and it has established policies and guidelines for individual matters to ensure thorough compliance. (These include the handling of personal information, preventing harassment, revenue recognition accounting standards, subcontracting operations, and export license applications.)

Efforts to Disseminate Policies and Improve Understanding

The Hagiwara Electric Group conducts a variety of training programs, including compliance training, for all Group employees in order to familiarize them with our policies and improve their understanding. We are also striving to strengthen our systems through complementary measures, such as our whistleblowing system and intellectual property checking management (to avoid the risk of patent infringement).

- Compliance training (once per year)

- Information security training (once per year)

- Subcontracting Proceeds Act lecture (once per year)

- Security trade control lecture (once per year)

- Holding e-learning lectures on legal affairs (one lecture every two or three months)

- Sending out compliance-related reports (once every two months)

…and more

Information Security

Basic Approach

The Hagiwara Electric Group recognizes that ensuring information security is one of its most important issues we face, and we have established a basic policy on information security with the aim of protecting the Group’s information assets.

Information Security Promotion System

Under the supervision and management of the Sustainability Committee, the Group has established a Group Information Security Committee, which discusses information security measures and matters to be considered, compiles measures to be implemented, and works to enhance risk management, etc. It also conducts information security training for all Group employees to ensure awareness and diligence regarding information security.

Basic Policies

The Hagiwara Electric Group has established the following as its basic policies: the establishment of an information security management system, the protection of information assets, compliance with laws and internal regulations, conducting education and training, and reviewing and improving. We have also established policies and guidelines for individual matters. (These include access control guidelines, remote-access service use guidelines, and guidelines for bringing equipment onto and off of the premises.)

Measures and Initiatives

The Hagiwara Electric Group is working on systematic measures, such as anti-virus measures, as well as personnel-related measures, such as information security training for all Group employees.